In 2023, Russian sales of sexual health products increased by 38%, and the volume by 43%. Market experts attribute this rapid growth to the fact that Russians are more frequently turning to sex to relieve stress. As a result, adult products are selling better than products traditionally used to relieve anxiety (alcohol, sweets, antidepressants).

The Russian market for products for people over 18 (including sales of sex toys, lotions, erotic lingerie, dietary supplements and souvenirs, but excluding condoms) will grow by 38% in 2023, reaching 48.8 billion rubles. Last year, Russians bought about 50-53 million of these items (an increase of 43% compared to the previous year). This is the conclusion reached by a survey conducted by the famous Forbes happiness provider (one of the largest sellers of adult products).

“Market growth peaked during the epidemic, after which sales jumped by 75% to 16.8 billion rubles at the end of 2020.” (the market size at the end of 2019 was 9.6 billion rubles). But after the epidemic, growth accelerated. In 2021, it grew by 27% to 21.3 billion rubles, and a year later – by 66% to 35.4 billion rubles.

to use“Chewing” to relieve anxiety

In the study, analysts at Supplier of Happiness found a link between demand for adult products and traditional stress-reducing products like alcohol, antidepressants and candy.

Consumption of these product groups will continue to increase from 2022. Sales of sweets increased by 19.8% over the past 12 months (from March 2022 to March 2023), according to Nielsen IQ. In addition, sales of antidepressants and sedatives in Russia increased by 30% in 2023. Russians bought 4.1% more alcohol in stores in 2023 than in 2022, according to the Federal Agency for the Alcohol and Tobacco Market. As a result, consumption is increasing in all groups of “anti-stress” products until 2023. Among them, sales of sexual health products are even more impressive.

“Our research shows that at least 25% of men and 10% of women believe that sex relieves stress. Alcohol and sweets were slightly more popular than sex, with around 30% of respondents choosing alcohol (up from 8% of women), and around 25% of women and 12% of men choosing sweets as a way to relieve stress,” says Korovitsyn of The Happiness Supplier:

“When stress persists, people tend to relieve their anxiety by meeting their basic needs,” says Marina Petrova, president of Petrova Five Consulting.

“Stress is responsible for the growing market of ‘alternatives to happiness’ such as candy, alcohol, tobacco, antidepressants and adult products,” she continued.

For example, experts explain that Russians try to relieve anxiety by “chewing”. “In times of stress, people try to cope with two emotions: anger and irritability lead to the need for chewable products (products containing nuts or hard caramel), while the desire for tenderness and affection leads to mousse desserts and other categories.” .

Petrova also said that the growth of the adult products market is not only a way to reduce stress, but also a generational change. “More than 50 million Russians were born after 1991, their lifestyle is more liberal and they are more willing to try everything.。“

adult productsAlso sold on Ozon “Russian Amazon”

Changes in distribution methods also seem to be contributing to the growth of the adult products market to some extent. In fact, with the shift from offline to online stores, the demand in the field of sexual health is also increasing.

Korovitsyn claims that online marketplaces have taken over the adult goods trade. According to 2GIS Geoservices (from Forbes magazine), the number of offline adult goods stores in cities with a population of one million will decrease by 6.4% to 897 in 2022. 2GIS has not released any new data since then. However, Korovitsyn expects that “another 3% of offline stores will close in 2023.”

He said that by the end of 2023, e-commerce will account for 73.7% of the market. “The online market for the 18+ group is dominated by ‘Young People’people‘Come onDominant, they sell unbranded goods imported from China or order cheap products under their own brands from production plants in China, India, Russia and Belarus. “These are private label (STM) owners who do similar things,” Korovitsyn said.

These entrepreneurs account for 88% of sales on the online market, with sales of private labels increasing by 70% last year, from 18.8 billion rubles to 32 billion rubles. Due to their presence, the average cost in the field of sexual health has not increased (currently, according to Forbes, it does not exceed 810 rubles). However,soldThe quantity and the corresponding amount are increasing, and with them, the per capita consumption of Russian citizens is also increasing.

In addition, representatives of the Russian online market confirmed that sales of sexual health products continue to break records.

“Sales growth in the 18+ category is expected to reach 70% through the end of 2023,” a Wildberry News Service representative said., “averageAmountIt remained practically unchanged at about 700 rubles. At the same time, the number of sellers increased by 52% compared to the previous year, and the share of private label creations also increased. About 70% already come from China.

investigationIt shows that sales of adult products on the large Russian online marketplace Ozon (also known as the “Russian Amazon”) are growing steadily.

“In 2023, sales of products aimed at people aged 18 and over will increase by 53% year-on-year and by 57% in value. The fastest-growing products are sexy lingerie, sexy cosmetics, sex toys, etc. The category has grown by almost 1.5 times, including Russian brands, the average transaction value of the category remains at 2022 levels, but the value will vary depending on the product category,

For example, in the fourth quarter, the average transaction value by gender was at 2022 levels. In the field of toys, prices exceed 1,200 rubles, condoms and lotions remain around 500 rubles.

He also said that buying adult products through online channels was a habit among Russians and would become increasingly popular. In Ozon,Customers in the 18+ category buy more frequently than once a month。

The share of private brands continues to grow

Lesser-known private label products have begun to replace classic Western brands on the Russian market. According to a study by Supplier of Happiness, by the end of 2023, the share of private labels in the categories of “lotions” and “sex toys” will exceed 85% of all products sold in Russia for those over 18.

Local manufacturers are talking about an influx of private labels. “Last year, we saw an exponential increase in the number of people wanting to launch their own brands in the sexual wellness category.” This surprises Andrei Narukunas, PR director at Jaga Jaga, a Russian manufacturer of sexual wellness products, who is published by Forbes magazine.

“Two or three years ago, few people would have considered starting a business in the adult products sector, and even if they wanted to, most people never had the time to do it. They just had to bring the goods and repackage them. Currently, there is fierce competition in the market. Price competition leads to constant comparisons of prices for the same product on different trading platforms, which leads to products disappearing from traditional retail shelves or being dumped.

Take care of yourself Take care of yourself I have been manufacturing sexual health products since 2000. The company manufactures over 1,300 products in over 18 categories (sex toys, lotions, love cosmetics and perfumes, nutritional supplements and massage oils).

How difficult is it to launch a brand in this market? “A simple form of collaboration is for sellers to customize the products they buy, rather than branding them when they leave the factory,” says Narukunas.

“The single price of such a contract can start from the cost of a small batch, about 50,000 rubles, which is somewhat difficult for the customer, the seller, but in terms of the overall production volume, the customer usually does it. The customer sends the packaging and labels. Give them to us, and we will realize the products packaged and affixed to the customer’s private label.

Both methods do not require certification of private label products and can use the manufacturer’s certificate or declaration.

Some special customers have their own specifications, Narukunas said. They order specific products developed and manufactured in specific packaging with specific characteristics and functions. The starting price of such a contract is 1 million rubles. “In addition, sellers need to obtain claims and certifications for many products, such as dietary supplements,” he warns. The third approach is more expensive because it requires research and development work for product development, small and large production batches, and separate declarations and certifications.

Korovitsyn predicts: “By the end of 2024, barring any economic disruptions, the market will grow by at least 20% to 60 billion rubles. He believes that this is mainly due to the development of the 18+ category in the online market.” existing and new players Continued development of private label varieties.

It predicts that by 2024, up to 80% of sexual health product sales will be online, with private label market share reaching 72.4%.

Anal Beads

Anal Beads Anal Vibrators

Anal Vibrators Butt Plugs

Butt Plugs Prostate Massagers

Prostate Massagers

Alien Dildos

Alien Dildos Realistic Dildos

Realistic Dildos

Kegel Exercisers & Balls

Kegel Exercisers & Balls Classic Vibrating Eggs

Classic Vibrating Eggs Remote Vibrating Eggs

Remote Vibrating Eggs Vibrating Bullets

Vibrating Bullets

Bullet Vibrators

Bullet Vibrators Classic Vibrators

Classic Vibrators Clitoral Vibrators

Clitoral Vibrators G-Spot Vibrators

G-Spot Vibrators Massage Wand Vibrators

Massage Wand Vibrators Rabbit Vibrators

Rabbit Vibrators Remote Vibrators

Remote Vibrators

Pocket Stroker & Pussy Masturbators

Pocket Stroker & Pussy Masturbators Vibrating Masturbators

Vibrating Masturbators

Cock Rings

Cock Rings Penis Pumps

Penis Pumps

Wearable Vibrators

Wearable Vibrators Blindfolds, Masks & Gags

Blindfolds, Masks & Gags Bondage Kits

Bondage Kits Bondage Wear & Fetish Clothing

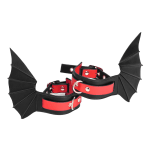

Bondage Wear & Fetish Clothing Restraints & Handcuffs

Restraints & Handcuffs Sex Swings

Sex Swings Ticklers, Paddles & Whips

Ticklers, Paddles & Whips